I just got a cash rewards business credit card from Chase.

There are some pros and cons of using this card.

Things I like about the cash rewards business credit card.

Cash back

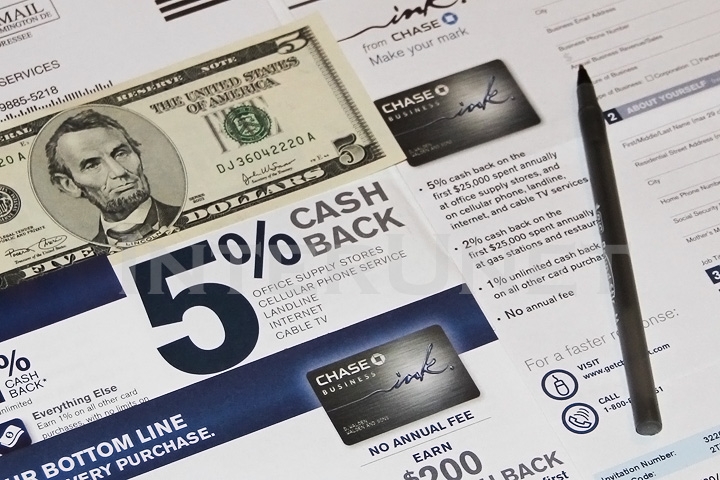

By using Chase Ink business credit card I will earn:

5% cash back at office supplies stores, on internet, cable TV, landline and cellular phone

2% cash back on gas purchases and at the restaurants

1% on all other purchases

Bonus cash

After spending $3,000 in purchases during first three months after account opening, I will get $300 cash back. That is a great offer. Besides rewards, I will receive an additional 10% balance reduction just for paying bills and making business purchases.

0% intro APR on purchases and balance transfers for the first 12 months

No worries about interest for the first year. If you do not have enough money to pay off the balance every month – just make minimum payments.

No expiration on rewards

If your account remains in a good standing, rewards that you’ve earned do not expire and could be redeemed any time for cash back, gift cards, travel or other available options.

No annual fee

Most credit cards nowadays have $0 annual membership fee. This card is not exclusion.

What are disadvantages to be aware of?

Credit card was already activated

Since 2005 I applied and received quite a few personal and business credit cards. None of them came activated. This is the only card which I was able to use right after opening an envelope brought by a mailman. There was no sticker on the new credit card stating something like: “This card is not active for security purpose. Call //phone number// to activate the card”. I swiped this credit card at gas pump and it works. Just like that. I consider this is not safe and not sure why Chase does that.

Plastic was in scratches

After opening an envelope with a new business credit card from Chase, I noticed the plastic itself was in scratches all over. That was even more concerning. It doesn’t look the card was swiped as damages were from the front side where the card number and name appeared, but still strange. The very next day, I checked the balance and it was only my gas purchase, so no fraud charges yet, but I already concerned about security of this credit card.

$25,000 limit

All 5% and 2% cash back will be applied only on first $25,000 you spend each year. After that you will earn 1% cash back. It’s not actually a huge minus for me, because most likely I won’t go over 25K a year, but for those who make large purchases every month it’s good to know.

Is Chase Ink business credit card the best credit card I own?

With only rewards in mind, I do not plan to utilize available credit limit on my new Chase Ink business cash credit card just to get 1% cash back. It seems like this is the good credit card, but not the greatest for each and every purchase. I will certainly use this card to buy office supplies and pay internet and phone bills. Gas is a huge expense for me, but high probability I will use US Bank Business Cash credit card at a pump just because of 3% cash back on gas purchases. Each quarter I can activate 5% cash back on selected categories on my Chase Freedom credit card. Citi double cash credit card which brings me 2% cash back on each and every purchase will be used as least rewarded option.

Getting over 11% cash back

October 2016 update

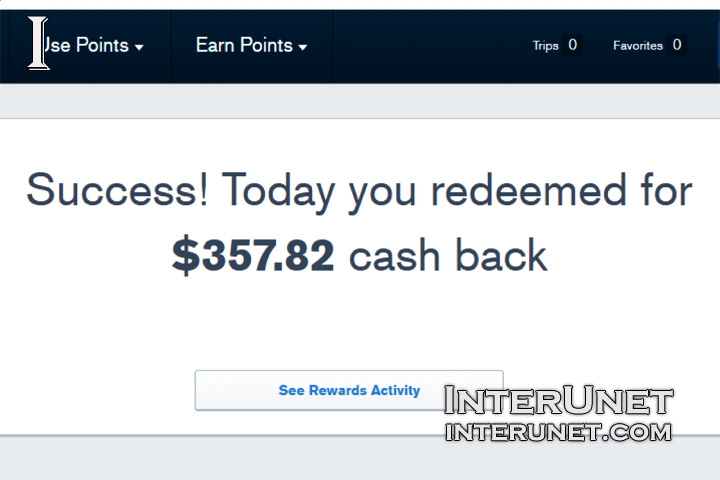

On my fourth statement I saw $300 bonus was applied to my cash rewards balance. For the first three months I spent around $3,210 in net purchases and received $357 cash back in rewards. The cost of goods and services I paid for with this credit card was reduced for more than 11%. Opening this account was a great decision and Chase Ink Business Cash credit card saved me extra buck. This business credit card becomes my favorite to pay internet, cable, and phone bills as well as buying office supplies.

Points redemption

There are many ways you can redeem earned points including gift cards, statement credit or deposit to the checking or savings account. I credited all cash to the Chase credit card. Applied amount reduced the balance on the card, but it doesn’t count as a payment, and you still have to make a minimum payment for the month points were redeemed.