To get the most from these holidays shopping I opened a new credit card.

Why Chase Freedom Unlimited?

$150 cash back

Periodically I receive prescreened offers from financial institutions to apply for credit cards or lines of credit. Most banks offer $100 bonus if I spend $500 in qualifying net purchases in the first three months after account opening. Offers with higher cash back require at least $1,000 in purchases during first 90 days. Chase offer was one of the best for me because I do not plan to pay over $300/month for products and services with a new credit card.

1.5% cash back

In addition to one-time bonus I will receive 1.5% cash back for each $1 spent. Rewards points on Chase Freedom Unlimited credit card do not expire and could be redeemed in the form of statement credit or electronic deposit into checking or savings accounts.

0% intro APR for 15 months

For the first 15 months I do not pay interest on purchases and balance transfers. If you cannot pay off the whole balance on the card, just make minimum payments every month with no worry about interest.

Application process

If you have accounts with Chase, the application process is very simple. At a local branch it took less than 15 minutes to fill the application and get an approval for a new credit card.

Rewards redemption

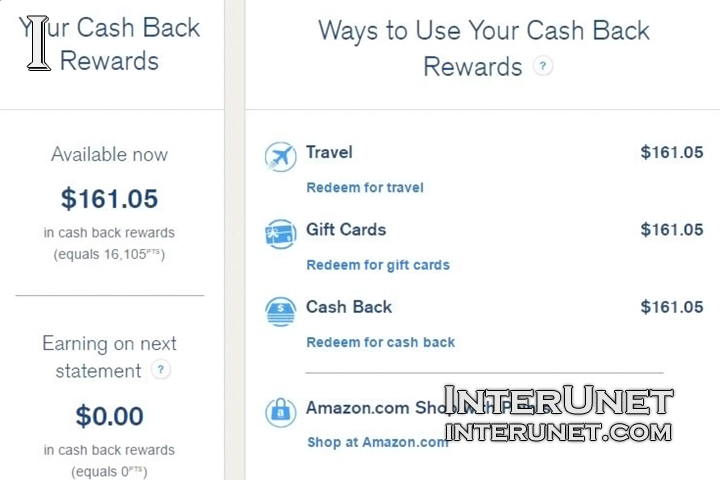

After my third statement closing date I received $150 bonus plus 1.5% on every dollar spent generated about $11 extra cash.

It is very simple to convert the points you’ve earned by using Chase Freedom Unlimited Credit Card into actual rewards. Chase offer a few ways to use your cash back rewards including redemption for travel, gift cards, statement credit, and deposit money to a bank account or shop with points on Amazon.com.

I’ve chosen statement credit as an option for my points earned redemption. It reduced balance on the credit card, but it doesn’t count as a payment and I still have to make at least minimum payment to avoid possible financial charges and late payment fees.

For the first three months I’ve got the most cash from Chase Freedom Unlimited Card. About $700 spent brought $161 cash back into my pocket. It’s over 20% savings on purchases.

How good is this credit card?

For a short term use, Chase Freedom Unlimited is a good credit card because of $150 bonus, extra 1.5% cash back and 15 months 0% annual percentage rate on purchases and balance transfers. For a long term it is not the best credit card I own. After utilizing all potential rewards I will probably use this card only in case I cannot get anything better than 1.5 points for each $1 spent.