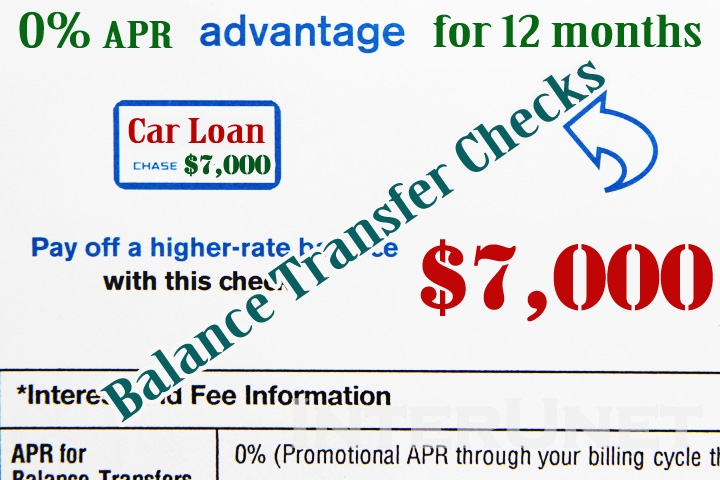

Transfer high interest balances, make larger purchase, or get extra cash with Chase Freedom 0% APR checks.

Get the most from your credit card

Using 0% interest promotional annual percentage rate checks is a great way to utilize a credit card limit for paying higher interest balances. It is one of the best options to get cash with lowest APR. None of the bank will lend you $10,000 with 3% interest rate. Typically APR for personal loans and lines of credit vary from 7.99% with excellent credit to 20.99 or even more if your credit history is not that good.

Balance transfer fee

I have Chase Freedom cash back credit card, and they periodically send me checks with 0% APR for 12 months. I simply deposit it to a checking account and use the money when in need of extra cash. There is a balance transfer fee you should be aware of. Some checks I receive have 2%, some 3% fee of the amount of each transaction with $5 minimum charge. For every $5,000 written check, Chase charged me $100 (accounting 2% transfer fee).

Read the whole story

There are some limitations and restrictions clearly stated under promotional checks. Everything is pretty clear – do not write checks that exceed $15,000 or make sure you have enough available credit. But the most important thing is you will not have interest free period on purchases made after using these checks unless your card will have $0 balance every month.

The real numbers. You deposit $7,000 promo check, and then made $500 in purchases during the same billing cycle. At the end of the month you own $7,640 (including 2% balance transfer fee). You made $2,000 payment, but on $500 bank will charge interest. The only way to avoid interest is to pay $7,640 at the end of the month.

Do not get catch by 0% APR alone

Getting cash or transferring higher interest balances with these checks certainly might save you on interest, but only if you are able to eliminate the balance before promotional rate expires. Otherwise, count better and take into account other options. It is especially true when you plan to use the money for a larger purchase. After promotional period standard balance transfer APR will apply and you are looking at minimum 12% to over 23% interest on remaining balance. In the result, you might overpay too much over longer period of time.

Chase credit cards fraud department

Do not be surprised if in a few hours after depositing a check you will get an automated phone call or a message from Chase credit card fraud department. They will notify you about potentially suspicious activity on the credit card and you have to confirm transaction. It is certainly a positive security feature which helps to protect the card from unauthorized use.